Starting October 1, employees who meet the required criteria will begin receiving their full pension benefits.

This long-awaited update marks an important step toward securing a more stable retirement for many workers. In this post, we’ll walk you through the details of this new pension policy, who qualifies, and how to apply.

Understanding the New Pension Policy

The policy coming into effect on October 1 is designed to provide full pension benefits to employees who have consistently contributed to their retirement fund over a certain period. This change aims to offer retirees greater financial security after years of dedication and hard work. By guaranteeing full pension payouts, the policy helps retirees maintain a better quality of life during their retirement years.

However, eligibility is key, and understanding the application process is essential for employees who want to benefit from these new provisions.

Who Qualifies for the Full Pension?

To qualify for full pension benefits starting October 1, employees must meet specific criteria related to their age, years of service, and contribution history. Generally, the first requirement is that the employee should be at least 60 years old. Those younger than this may qualify for partial benefits depending on their contributions and length of service.

In terms of service, employees typically need to have contributed to their pension fund for a minimum of 20 to 25 years. This ensures that the full pension benefits go to those who have consistently participated in the pension system over a significant period.

Another important qualification factor is having a verified record of pension contributions. If an employee’s payment history is incomplete or has gaps, they might not be eligible for the full pension but could still receive partial payments.

Keep in mind that some pension administrators might allow exceptions for certain cases, such as employees with disabilities or those who experienced interruptions in their careers.

How to Apply for the Full Pension

Once you confirm your eligibility, the next step is to apply for your full pension benefits. The process itself is relatively straightforward but requires careful attention to detail.

First, you’ll want to gather all the necessary documents. These include proof of age, such as a birth certificate or government-issued ID, employment records that verify your years of service, and identification documents like a national ID or passport. In some cases, proof of residency may also be required. Checking with your employer’s HR department or the pension fund office can help you confirm exactly what you need to prepare.

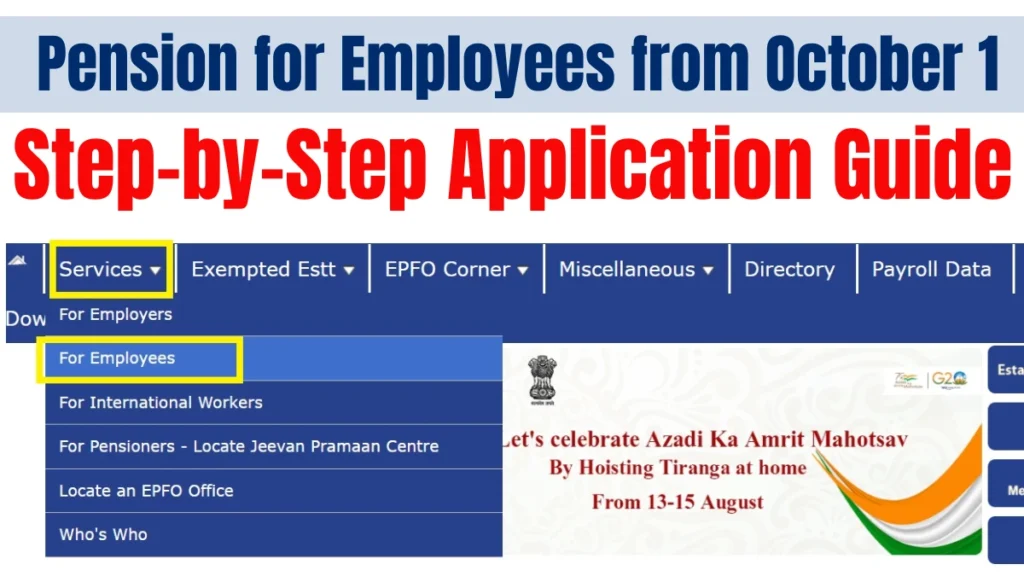

Next, you have the option to submit your application either online or in person. Many pension funds now offer online portals that allow you to apply from home. If you prefer a more hands-on approach or have difficulty using digital platforms, you can visit the pension office directly to complete your application with assistance from their staff.

When filling out the application form, be prepared to provide your personal details, employment history including the dates and names of your employers, and your pension contribution records. Accuracy is crucial here, as any mistakes could delay the approval process.

After completing the form and attaching your documents, submit your application. If applying online, you will usually receive immediate confirmation along with information on how to track your application status. For in-person submissions, you should receive a receipt or acknowledgment, which you should keep safe for future reference.

The pension fund will then review your application. This stage may take several weeks or longer, depending on how many applications are being processed and how complex your case is. The pension office might reach out to request additional information or clarification, so be sure to respond promptly if contacted.

Once approved, your full pension benefits will begin, usually paid monthly either by direct bank transfer or another method chosen by the pension fund.

Key Considerations and Tips

To make your application process smoother, it’s a good idea to apply well before October 1. This gives you ample time to correct any issues or provide extra documentation if needed.

Also, keep copies of every document you submit, along with any receipts or confirmations. This can be very helpful if you need to follow up with the pension office later.

Finally, stay informed about any updates or changes to pension policies. Being aware of new rules or deadlines ensures you won’t miss out on important information.

Conclusion

The introduction of full pension benefits starting October 1 is a major step forward for employees preparing for retirement. By understanding the eligibility requirements and carefully following the application steps, you can ensure you receive the benefits you’ve earned through years of hard work. Gather your documents, apply early, and stay in contact with the pension office to make your transition into retirement as smooth as possible.

Disclaimer: This blog post is for informational purposes only and does not constitute legal or financial advice. Pension rules and eligibility criteria may vary by region and individual circumstances. Please consult your pension fund administrator or a qualified professional to confirm specific details and ensure your application meets all current requirements.